So, it is important to understand the root cause of opening balance equity accounts and resolve the issue to ensure the accuracy of your balance sheets. The auditing of Opening Balance Equity accounts is a process that ensures the integrity and accuracy of a company’s financial records. Auditors examine these accounts to verify that the initial balances are correctly recorded and that subsequent allocations to other equity accounts are appropriate and in accordance with the relevant accounting framework. This examination involves a thorough review of the documentation supporting the historical balances and the rationale for any adjustments made. Financial professionals often scrutinize the Opening Balance Equity account to ensure that the balances are being correctly resolved. This scrutiny is part of the process of establishing a solid foundation for the company’s financial records.

What is Square And How Does It Work: A Quick Guide to A Popular Payment Platform for Business Owners

- You can enter an opening balance for a real-life bank account you just created, or one you’ve had for a while.

- This will almost always be from one of the situations described above where an opening balance was mistakenly entered into an account.

- The balance on this account represents the difference between the assets and liabilities of a business at the beginning of a new accounting period, which is the start of a new fiscal year or when a new company is established.

- It is calculated by taking the amount of money the owner of a business has invested and subtracting all liabilities and debt.

It is important to note that this account is temporary and should be closed out at the end of the period to ensure accurate financial reporting. This process plays a pivotal role in aligning the recorded balances with the actual financial position of the business, providing a foundation for accurate reporting and decision-making. It involves meticulously reviewing past financial records, identifying any anomalies or errors, and making the necessary adjustments to present a true and fair view of the organization’s financial status. The first step in zeroing out Opening Balance Equity in QuickBooks Online involves creating a journal entry to address the discrepancies and ensure accurate adjustments for financial statements and reconciliation procedures.

Common Errors to Avoid

If you’ve had the account for a while, start your opening balance on the same day as the beginning of your next bank statement. Whatever date you choose, use your bank statement to get the account’s balance for that day. Learn how to enter and manage an https://www.bookstime.com/articles/what-is-another-name-for-a-bookkeeper opening balance for bank, credit card, and other types of accounts. Just a disclaimer, I encourage collaborating with other accountants, especially on accounting for the adjustment entries before making significant changes to maintain accurate records.

You add a new item to the chart of accounts

- If you forgot to enter an opening balance when you created an account, don’t worry.

- – Close the balance equity to “Owner’s Equity” if the company is a sole-proprietorship organization.

- When setting up a new company file, QuickBooks will prompt users to enter the opening balances for each customer account.

- Zeroing out Opening Balance Equity in QuickBooks Online enables a clearer understanding of business performance, facilitating informed financial decision-making and strategic planning.

This could be either a revenue or expense category, an asset account, a liability account, or a different equity account. Seeing a balance in the OBE account during the initial setup of an accounting system or after making adjustments is even a frequent occurrence connected mostly with unallocated funds. At this point, you will see how the balance on your opening balance equity account decreases to the total of your liability accounts. You might want to know your opening balance, as it tells you what you had before any new transactions or changes happened. It’s like the foundation of your financial records, helping you keep track of everything accurately.

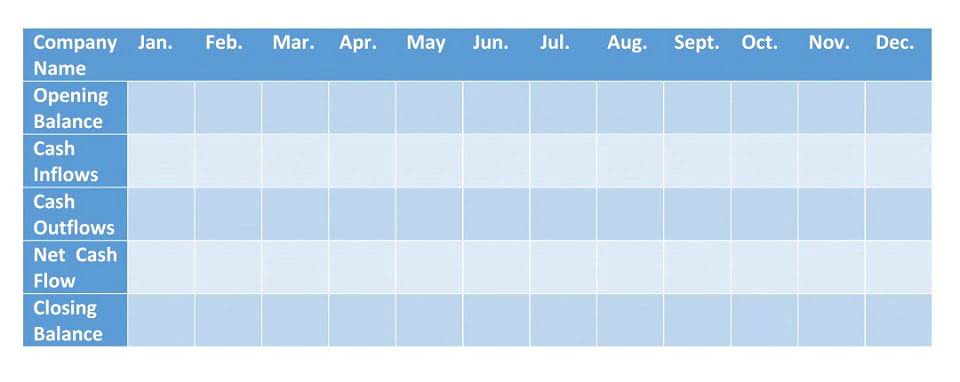

Your accounts in QuickBooks need to match the real-life bank and credit card accounts you’re tracking. When you create a new account in QuickBooks, you pick a day to start tracking transactions. Then, you enter the balance of your real-life bank account for whatever day you choose. This action enhances the overall management of financial records by ensuring that the reconciliation process aligns with the actual financial transactions.

An opening balance is the amount in a financial account when a new period begins, like a new year or month (it also applies to when you set up a new company file in QuickBooks). In other words, it’s the first number you see when looking at your finances for a new period. As mentioned above, opening balance equity is needed to ensure that your accounting remains balanced and that the financial records of a business are accurate. But imagine you creating a company file in QuickBooks, and it pops up seemingly out of nowhere, showing some balance on it. No need to worry because QuickBooks creates it automatically as you start setting your accounts and inserting your opening balances there. You will enter the amount of money your business starts with at the beginning of your reporting period (usually the 1st of each month).

Impact of Incorrect Opening Balance Equity on Financial Statements

Keep in mind that entering opening balances correctly is crucial for the accuracy of your financial records. Any errors or omissions in the opening balances can lead to discrepancies in your financial statements and affect the overall integrity of your accounting data. Therefore, it is essential to pay close attention and gather all the necessary information before proceeding with entering the opening balances.

- To ensure everything is recorded correctly, it’s best to consult a bookkeeper or collaborate with other accountants for further assistance.

- I tried to do my research but I am still having a hard time understanding the function of Opening Balance Equity.

- You may want to check our Find an Accountant tool to find another accountant near you to gather ideas addressing this issue.

- By entering the opening balances for your sales tax, you ensure that your financial records accurately reflect your sales tax liabilities.

- When these new accounts are established, it is necessary to adjust the Opening Balance Equity to allocate the correct starting balances.

- The Chart of Accounts is a list of all accounts used by a company to record financial transactions.

This crucial step not only helps in maintaining financial accuracy but also allows small businesses to have a clear understanding of their financial position. Unreconciled transactions can significantly impact the accuracy of a company’s financial statements, leading to misrepresentation of financial performance. Timely identification and resolution of these discrepancies are vital for the overall health of the business. This isn’t a major issue because it doesn’t affect income and expense, but you should transfer this amount to a properly titled equity account, like Paid-in Capital, using a journal entry. Whichever the reason is, having funds left in the opening balance equity account can cause problems for financial reporting. They mess up financial statements, making it hard for people to properly analyze a company’s financial performance and see how the company’s doing.